Financially Investing in Yourself 101

This applies to those new to financial investing for retirement in Canada. These are the recommendations I usually make, so I'm summarizing here.

- Pay down any debts with more than 10% interest as fast as you can.

- Once your debts are paid off, save until you have a 3 month float in the bank in case you become unemployed

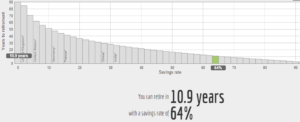

- Start saving for retirement, and this is where the numbers really stand out. If you can save 64% of your income, you can retire in less than 11 years.

[caption id="attachment_873" align="aligncenter" width="550"] Years to Retirement[/caption]

Years to Retirement[/caption]

This is pretty simple. If you're spending 100% of your income, instead of saving it, you will never be able to retire without something else happening. If you're spending 0% of your income and can maintain that, you're ready to retire right now. The graph above shows the options in between. Mr. Money Mustache breaks this down in more detail.

- If you don't own real estate yet and want to, this is where you can start to max our your RRSPs until you've reached $25,000, which you can then loan yourself tax-free under the Canadian Home Buyers Plan. This only applies to your first property.

Leave a comment